Markets Update: Cryptocurrency Bulls Continue to Charge

Over the past few days, cryptocurrency markets have been showing bullish gains after a few small retractions during the weekend. At the moment the entire digital asset economy is valued at $285Bn while $14.3Bn worth of trades were swapped over the past 24-hours. Today on July 23 bitcoin core (BTC) markets are holding an average price of $7,700 per BTC. Meanwhile, bitcoin cash (BCH) prices are hovering around $815 per BCH at press time.

Also read: A Discussion With the Prolific Bitcoin Developer Unwriter

Are the Tides Turning for Cryptocurrencies?

A good portion of cryptocurrencies on Monday are seeing some gains after some good dips that took place over the weekend. Most digital assets are consolidating losses while a few others like BTC, BCH, LTC, and XMR are up between 1-2% today. Bitcoin core dominance (the percentage of BTC’s market capitalization among all 1,600+ assets) has been steadily moving up over the past few weeks and touched a high of 46 percent today. The top five digital currencies with the most trade volume today includes BTC, USDT, ETH, EOS, and BCH. Many crypto-enthusiasts and traders are optimistic the tides have changed after months of bearish prices plagued cryptocurrency markets.

Bitcoin Core (BTC) Market Action

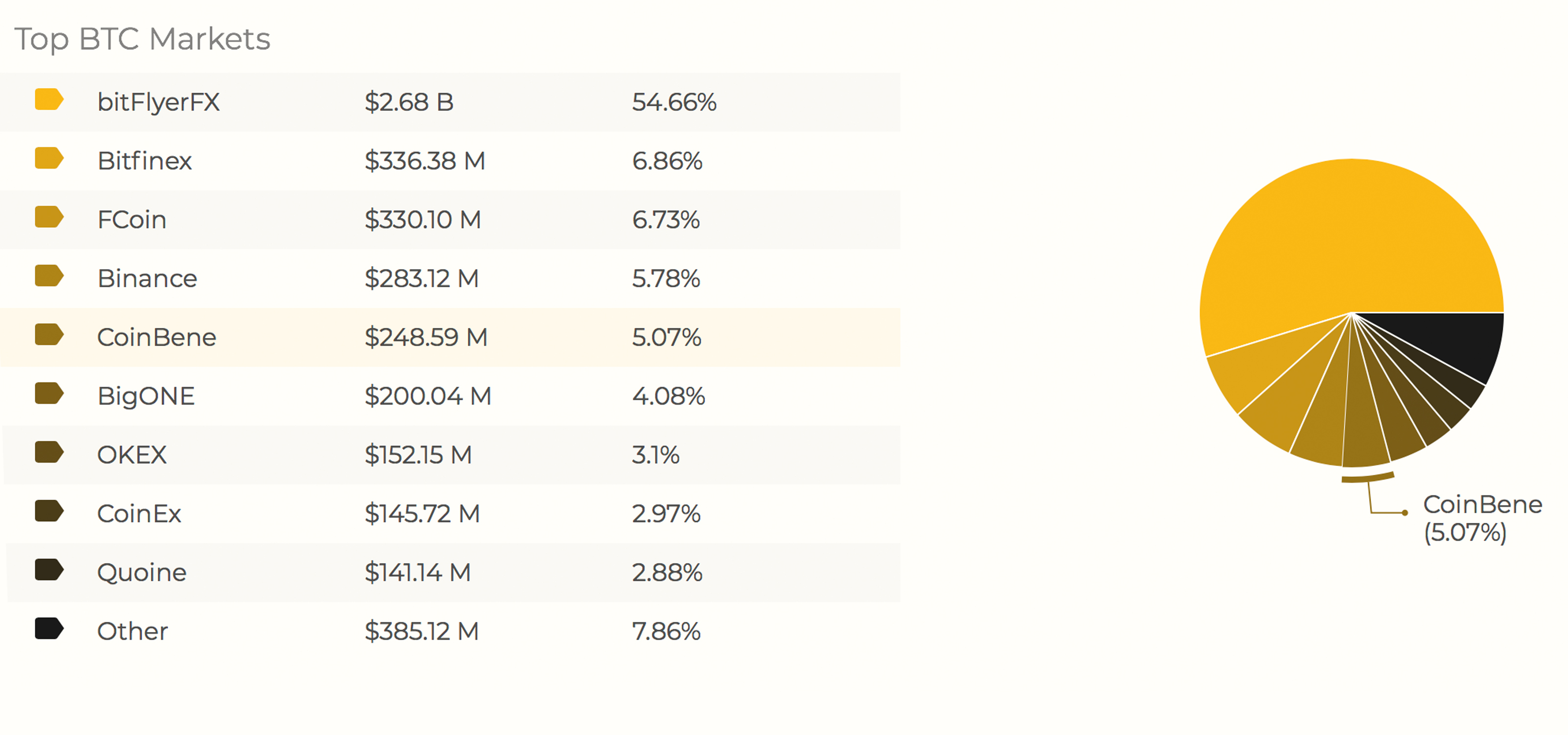

Bitcoin core (BTC) market action shows the cryptocurrency is being sold at prices between $7,650-7,710 per coin. BTC’s market capitalization is around $132Bn, and 24-hour trade volume is about $4.8Bn worth of swaps. The top exchanges trading the most BTC include Bitlfyer, Bitfinex, Fcoin, Binance, and Coinbene.

The Japanese yen is the most dominant pair today with BTC commanding more than 54 percent of global trades. This is followed by tether (USDT 28.8%) USD (11.3%), EUR (2%), and KRW (1.5%). The top trade today on the peer-to-peer cryptocurrency exchange Shapeshift.io is ethereum (ETH) for bitcoin core.

BTC/USD Technical Indicators

Looking at the BTC/USD charts on Bitstamp and Coinbase shows BTC bulls are trying to break massive resistance between the current vantage point to get past the $7,950-8,100 regions. The 4-hour chart shows the Relative Strength Index (RSI 62.9) is nearing the overbought zone at press time. However, the 100 Simple Moving Average (SMA) is above the longer term 200 SMA, which means buyers could take the upside after breaking some more resistance. MACd lines continue to confirm short-term upper movement is in the cards as the MACd histogram shows room for more improvement.

So far it looks as though bulls could press past the $8K region as the upside trend looks strong while observing the Average Directional Index (ADX). Looking at order books shows BTC bulls have some thick resistance to crack above the EMA 200 resistance $7,950 zone and there will be another pitstop around the $8,250 region. On the backside, if bulls get exhausted and bearish sentiment takes over there is strong support between now and $7,350 and also another stop at $6,850 if markets dropped lower.

Bitcoin Cash (BCH) Market Action

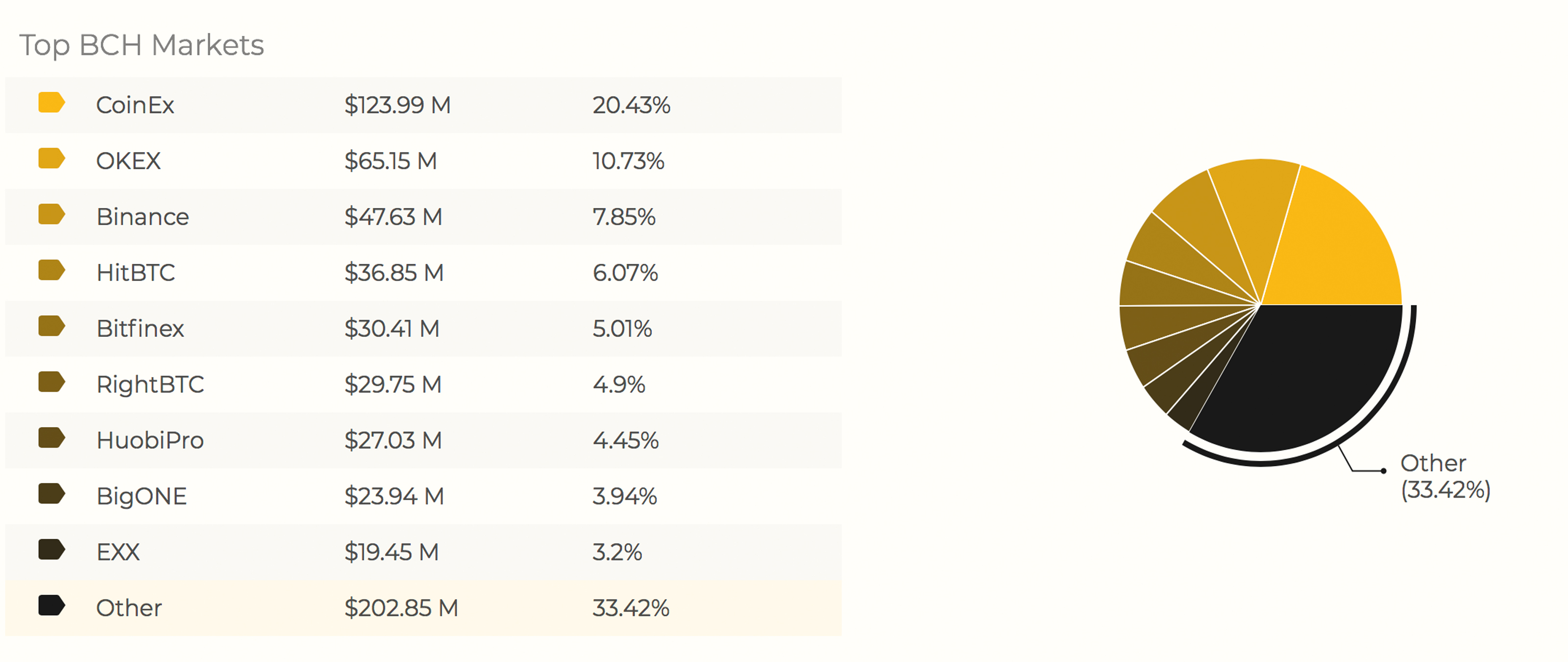

Bitcoin cash (BCH) markets are showing an average price of $820 per coin this Monday. The cryptocurrency currently has a market valuation of around $14.1Bn and trade volume has dropped a touch since our last markets update to $617Mn over the last 24-hours. The top trading platforms exchanging the most BCH today includes Coinex, Okex, Binance, Hitbtc, and Bitfinex.

The biggest trading pair with BCH today is tether (USDT) which captures 50.4 percent of global BCH trades. This is followed by BTC (29.1%), USD (9.8%), KRW (2.4%) and ETH (2.35%). The EUR also commands roughly 1.7 percent of today’s BCH swaps on July 23.

BCH/USD Technical Indicators

Observing the technical indicators on the daily and 4-hour Bitfinex BCH/USD charts show the price has been somewhat stable lately with charts showing slight variances here and there over the past week. The short-term 100 SMA is slightly above the 200 SMA trendline indicating the path of least resistance should be towards the upside. The 4-hour chart indicates that the Relative Strength Index (RSI 52.4) is meandering in the middle showing a small period of trading uncertainty.

The Average Directional Index (ADX) confirms bulls still have the reigns, and the strength of market conditions remains solid for the short term. Looking at order books and the EMA 200 shows strong resistance between the $850-925 zone. BCH bulls will need to eat away at these orders to continue maintaining upward momentum. On the back side, order books show some strong foundations between the current vantage point and $760, while after that region books begin to thin out.

Could We Be on the Cusp of a Massive Bull Run?

Enthusiasts and traders are still skeptical of what will take place next within the land of cryptocurrency markets. All of the digital assets have had mediocre trade volumes since last week as general markets are seeing a slight dip in crypto-swaps over the past few days. Bulls are making some moves northbound but the volumes show conviction is lacking. However, many crypto-proponents believe the upcoming bitcoin-based exchange-traded-fund (ETF) decision this August is what’s fueling the current pumps over the last week. For example, the senior market analyst at Etoro, Mati Greenspan, believes a market reversal is imminent. Greenspan explains to his Twitter followers:

We might just be on the cusp of the largest bitcoin bull run in history.

Where do you see the price of BCH, BTC, and other coins headed from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Cryptocurrency Bulls Continue to Charge appeared first on Bitcoin News.

by Jamie Redman via Bitcoin News