Mobile Payment Market May Hit $4,574 Billion by 2023

The value of the mobile payment market was USD $601 billion in 2016, and it will reach $4,574 billion by 2023. These are the conclusions of an Allied Market Research survey. Incidentally, major companies in this market have enabled — or are planning to enable —Bitcoin payment features in their apps.

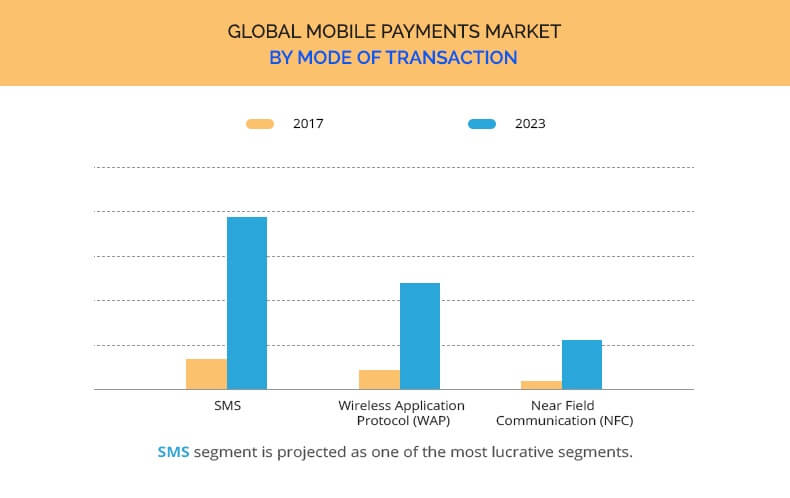

Survey: The Short-Message-Service Segment Will Continue To Grow

The payment for goods or services or exchange of money performed through smartphones and other mobile devices is surging exponentially.

The Allied Market Research study classifies the mode of the transactions into short message service (SMS), near-field communication (NFC), and wireless application protocol (WAP). And it concludes that the SMS is the segment that will grow the most. Specifically, “The SMS segment dominated the mobile payment industry in 2016 and is anticipated to grow at a rate of 33.5% during the forecast period.”

Although the mobile payment market is still in the maturity phase, customers rapidly appreciate how easy and convenient the method is. As a result, mobile phones are now replacing credit cards. Next, arguably, Bitcoin (BTC) 00 could eventually replace fiat money.

In effect, companies that dominate the mobile payment market today are already focusing on introducing Bitcoin and other crypto technologies for payment purposes.

Since Square, Inc. added Bitcoin trading features to its payment app, the value of its stock shares has skyrocketed. As of this writing, SQ is hitting a value of USD $100 per share, as shown in the chart below:

Square’s management remains optimistic about the penetration of Bitcoin and other cryptocurrencies into the mobile payment market. Consequently, the company relentlessly continues its efforts to expand the use of cryptocurrencies. For example, last August, the company tweeted that it was expanding the Cash App to all 50 U.S. states.

Red, white, and bitcoin. Now you can use Cash App to buy bitcoin in all 50 states. pic.twitter.com/D4fhVRz7WL

— Cash App (@CashApp) August 13, 2018

Additional Mobile Payment Company Jumps on the Bitcoin Wagon

On September 22, 2017, Square obtained approval from the U.S. Patent and Trademark Office (USPTO) for a new payment method patent that would allow merchants to accept any currency, including crypto ones. According to the filing document:

The disclosed technology addresses the need in the art for a payment service capable of accepting a greater diversity of currencies…including virtual currencies including cryptocurrencies (bitcoin, ether, etc.)

Likewise, USPTO granted MasterCard a patent for a method of speeding up cryptocurrency transactions, according to the document published in July 2018.

Glance Technologies Inc. is also enabling payments with Bitcoin. According to a press release dated September 18, 2018:

The new feature, Pay With Bitcoin, will enable Glance Pay users to pair their cryptocurrency wallet with their Glance Pay account, and then purchase Glance Dollars with Bitcoin. Glance Dollars represent a credit that can be spent instantly at participating merchants within the Glance Pay ecosystem.

Headquartered in Vancouver, Canada, Glance Technologies plans to roll-out Pay with Bitcoin this fiscal year.

What do you think about the growth of mobile payment companies providing peer-to-peer and Bitcoin payment services? Let us know in the comments below.

______________________________________________________________________

Images courtesy of Allied Market Research, Ameritrade, Shutterstock, Twitter/@CashApp.

The post Mobile Payment Market May Hit $4,574 Billion by 2023 appeared first on Bitcoinist.com.

by Julio Gil-Pulgar via Bitcoinist.com