Yandex: Beating Google in Europe’s biggest internet market

Welcome to the fourth in my series on alternatives to Google. It follows my piece No need for Google back in May and my in-depth reports on Ecosia, DuckDuckGo and Baidu.

Today we turn to Yandex. Since we last covered Russia’s search giant (way back in 2015) the engine has reasserted its dominance over Google in the market. It has a presence in other countries too and is branching out into numerous other tech verticals.

So let’s take a look at search in Russia and what Yandex is doing well in order to solidify its position. And what does the future hold for the brand and Russian search market at large?

A top-level view of digital Russia

Russia is the biggest internet market in Europe. It boasts more than 109m web users reaching 76% of the total population (according to Internet World Stats).

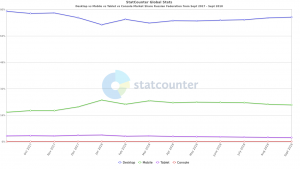

The size of the market may not be much of a surprise, but the country’s digital landscape does have some unique traits. Desktops, for instance, are still the leading devices by which Russian users engage with the digital world. According to StatCounter, more than 75% of the platform market is accounted for by desktop use – with mobile and tablet weighing in at 22% and 2% respectively.

This proportion of mobile/tablet users compared to desktop users is far smaller than other big European internet markets such as the UK (where handheld devices now equal desktops), as well as the continent as a whole (where mobiles account for around 45% of digital platform use).

Yandex vs. Google: Two separate battles on desktop and mobile?

It is arguable that Yandex’s popularity in the Russian market may be linked to the continuing popularity of desktops in the region.

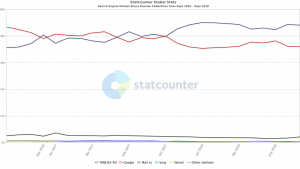

If we look at the overall search market across all platforms (again, using StatCounter data), Yandex’s share has grown from 38% to 53% between 2014 and 2018. If we focus in on desktops, we see Yandex’s share peaking at nearly 60% a little earlier this year.

It is a different story when we look more closely at the mobile/tablet search sector. In fact, things are almost exactly flipped with Google currently boasting 58% share of the market and Yandex second at 40%.

What is Yandex doing well?

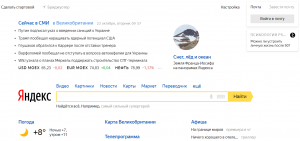

At first glance, Yandex doesn’t look much different to Google. The English-language Yandex.com homepage – with its generous white space and spare pictogram links to ‘images,’ ‘video,’ etc. – arguably bears even more similarity to the Google homepage than it does to the busier magazine-style design it uses for the Cyrillic versions of its own pages.

To US and UK audiences, then, Yandex’s Cyrillic design might look a little old fashioned. But this layout hints at the desktop-centric users it is appealing to in its domestic market. While in the design sense, the needs of the Russian market plays its part in keeping things quite traditional, the engine has been ahead of the curve in other ways. For instance, in being able to understand the unique nuances and inflections of the Russian language. This was certainly an initial USP for the engine, and is no doubt fundamental in keeping so many domestic users coming back to the service rather than making their searches elsewhere.

Aside from its dependable search functionality across text, image, video, and its portal homepage elements, Yandex has long been quick to branch out into other digital and technology services. Yandex.Disk is its cloud storage offering giving P2P sharing functionality and the ability to search your files straight from the search bar. Alice, the service’s voice assistant is taking the brand’s speech and language recognition capabilities even further.

More recently, Yandex.Music – with its smart playlists and massive library of streamable songs – has just launched in Israel (it’s first territory outside of the former Soviet Union). Yandex Taxi is also on the verge of launching autonomous cabs in the nation’s capital Moscow. Yandex’s developments inside and outside of search are united in that they are always quick to plug the gap in the Russian market as soon as the technologies are viable, and they are increasingly underpinned by machine learning and artificial intelligence.

The future for Yandex and Russian search?

Looking to the future, Yandex does potentially face some challenges. While the brand’s market share is on the upward trajectory, so too is the migration of Russia’s desktop users to mobile devices. This trend might be slower and steadier in Russia than in other markets, but the move to mobile must surely be seen as inevitable – and is likely to be key in giving access to the 24% of citizens who are currently disconnected.

Google is in a good position to benefit from any growing appetite for mobile search in Russia. This is due in no small part to the prevalence of the Android OS which currently accounts for more than 69% of the mobile OS market (including tablets).

But the Russian search market is a complicated one and things are very hard to predict. I wonder if Yandex will be able to make good in the mobile search sphere if, for instance, Russian consumers are lured by the advanced voice recognition services of Alice? Could new internet users be ‘straight to voice’ in the same way populations have been ‘straight to mobile’ in other emerging markets? Additionally, if other Yandex-branded apps, across such verticals as video and ecommerce, see further visibility as more Russian users come to mobile, will this help keep more mobile users on Yandex-owned mobile sites when they are searching for these respective types of content?

There might be more questions than hard predictions here, but out of all the alternatives to Google, Yandex is arguably one of the more clear-cut success stories. Winning once more in a massive domestic market with plenty of room for growth, growing in other countries and verticals, as well as pushing the technology envelope wherever it can. I’d be surprised if it went down without a fight, even if a Russian mobile boom happened tomorrow.

source https://searchenginewatch.com/yandex-beating-google-europes-biggest-internet-market/