US Bank That Serves 483 Cryptocurrency Companies Is Seeking an IPO

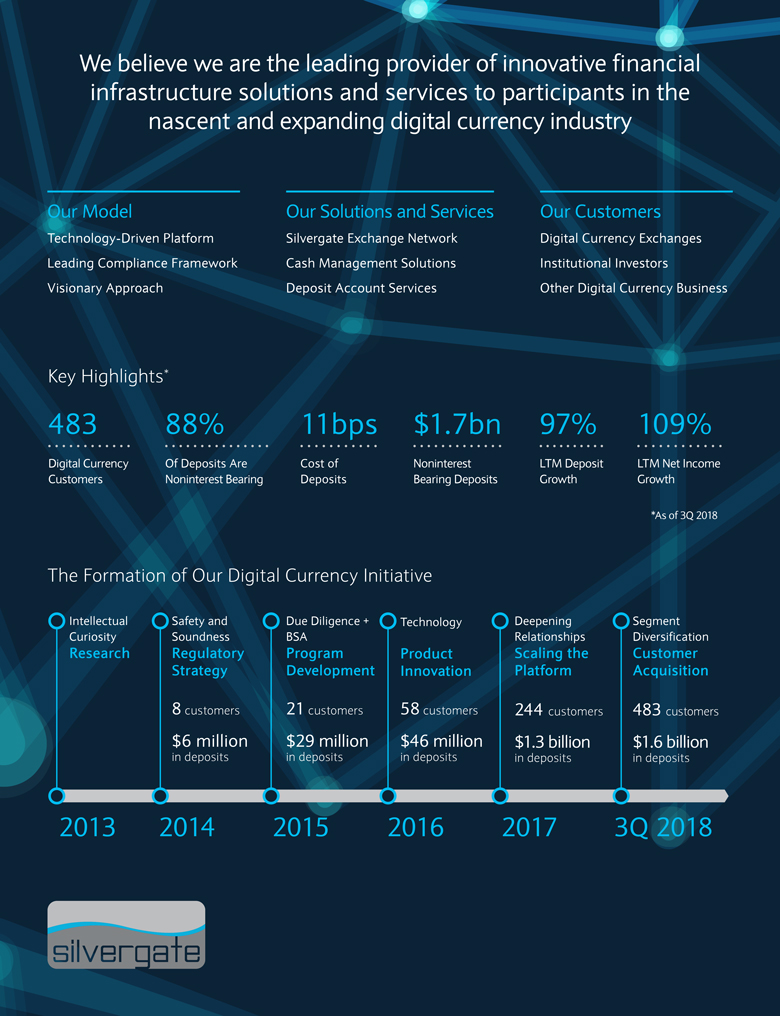

Silvergate Bank, headquartered in San Diego as a California state-chartered bank, started its cryptocurrency-related business in 2013. Now its parent company wants to go public, revealing that 483 companies from the crypto industry are using the services of the “bitcoin-friendly” bank.

Also Read: Survey Finds McAfee Is the Most Influential Crypto Trading Figure

$1.7B of Crypto Deposits

Silvergate Capital Corp., the parent of Silvergate Bank, recently filed a prospectus with the U.S. Securities and Exchange Commission to raise a maximum of $50 million by selling shares to the public on the New York Stock Exchange. Back in February, the bank sold 9.5 million shares, raising $114 million in a private placement.

Silvergate Capital Corp., the parent of Silvergate Bank, recently filed a prospectus with the U.S. Securities and Exchange Commission to raise a maximum of $50 million by selling shares to the public on the New York Stock Exchange. Back in February, the bank sold 9.5 million shares, raising $114 million in a private placement.

In addition to attracting hundreds of new clients, Silvergate Bank’s openness to the cryptocurrency industry has also enabled it to rapidly grow noninterest-bearing deposits, reaching $1.7 billion in the third quarter of 2018. The bank capitalizes on the funds it gets from crypto companies by deploying them into interest-earning deposits in other banks and investment securities, as well as into “certain lending opportunities that provide attractive risk-adjusted returns.”

Plenty of Room to Grow

The company reassures potential investors that the market niche it has carved out for itself still has plenty of room to grow. It estimates that “the addressable market for fiat currency deposits related to digital currencies alone is approximately $30 to $40 billion.” Additionally, Silvergate Bank reports it already had another 145 prospective cryptocurrency customers waiting in various stages of its customer onboarding process by the end of the third quarter of the year.

The company reassures potential investors that the market niche it has carved out for itself still has plenty of room to grow. It estimates that “the addressable market for fiat currency deposits related to digital currencies alone is approximately $30 to $40 billion.” Additionally, Silvergate Bank reports it already had another 145 prospective cryptocurrency customers waiting in various stages of its customer onboarding process by the end of the third quarter of the year.

Silvergate Bank’s most important group of customers — “some of the largest U.S. exchanges and global investors in the digital currency industry” — hold their investor funds and operating funds with the bank. Another group of cryptocurrency customers includes software developers, miners, custodians and general industry participants. These entities were said to account for 22.6 percent of the bank’s cryptocurrency customers as of Sept. 30, 2018. And the bank adds that “we believe this group presents future growth opportunities as the digital currency industry landscape continues to develop.”

Is this a sign that stock investors are still looking to enter the bitcoin ecosystem? Share your thoughts in the comments section below.

Images courtesy of Shutterstock.

Verify and track bitcoin cash transactions on our BCH Block Explorer, the best of its kind anywhere in the world. Also, keep up with your holdings, BCH and other coins, on our market charts at Satoshi’s Pulse, another original and free service from Bitcoin.com.

The post US Bank That Serves 483 Cryptocurrency Companies Is Seeking an IPO appeared first on Bitcoin News.

by Avi Mizrahi via Bitcoin News