Ethereum Price Analysis: ETH Consolidating Before Fresh Upside

Key Highlights

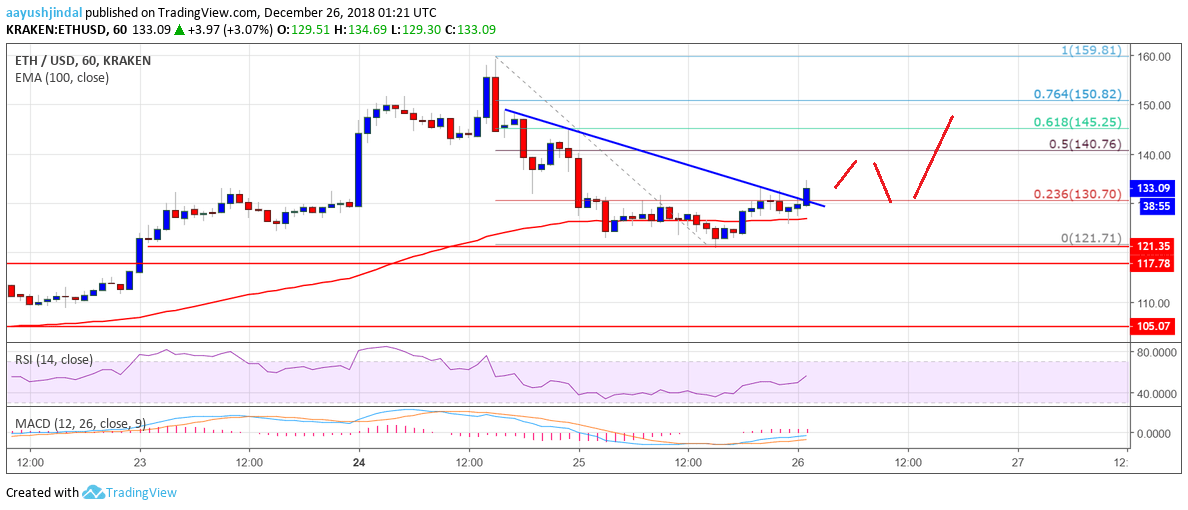

- ETH price tested the $120-121 support area and started consolidating against the US Dollar.

- There was a break above a short term bearish trend line with resistance at $130 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair may trade in a range for some time before a fresh upside towards the $140 level.

Ethereum price is holding important supports against the US Dollar and bitcoin. ETH/USD could resume its upward move towards $140 or $142 in the near term.

Ethereum Price Analysis

Yesterday, we discussed the chances of ETH price holding the 100 hourly simple moving average against the US Dollar. The ETH/USD pair did correct lower and tested the $120-121 support area. However, buyers were able to prevent losses below $121 and the 100 hourly simple moving average. A low was formed at $121.71 and later the price started trading in a range.

The price crawled back above the $130 level, with a positive angle. There was a break above the 23.6% Fib retracement level of the last decline from the $159 high to $121 low. Moreover, there was a break above a short term bearish trend line with resistance at $130 on the hourly chart of ETH/USD. It has opened the doors for more gains and the price may now trade towards $138 or $140. Besides, the 50% Fib retracement level of the last decline from the $159 high to $121 low is near the $140 level. Therefore, if the price continues to move up, it could face resistance near the $140 or $142 levels.

Looking at the chart, ETH price is holding the $121 support and the 100 hourly SMA. Therefore, there could be a decent upside move towards $140. On the flip side, if there is a downside break below $121, the price may decline to $112.

Hourly MACD – The MACD is slowly moving in the bullish zone.

Hourly RSI – The RSI is now placed above the 50 level.

Major Support Level – $121

Major Resistance Level – $140

The post Ethereum Price Analysis: ETH Consolidating Before Fresh Upside appeared first on NewsBTC.

by Aayush Jindal on December 26, 2018 at 09:38AM