Ethereum Price Weekly Analysis: ETH Facing Strong Resistance Near $140

Key Highlights

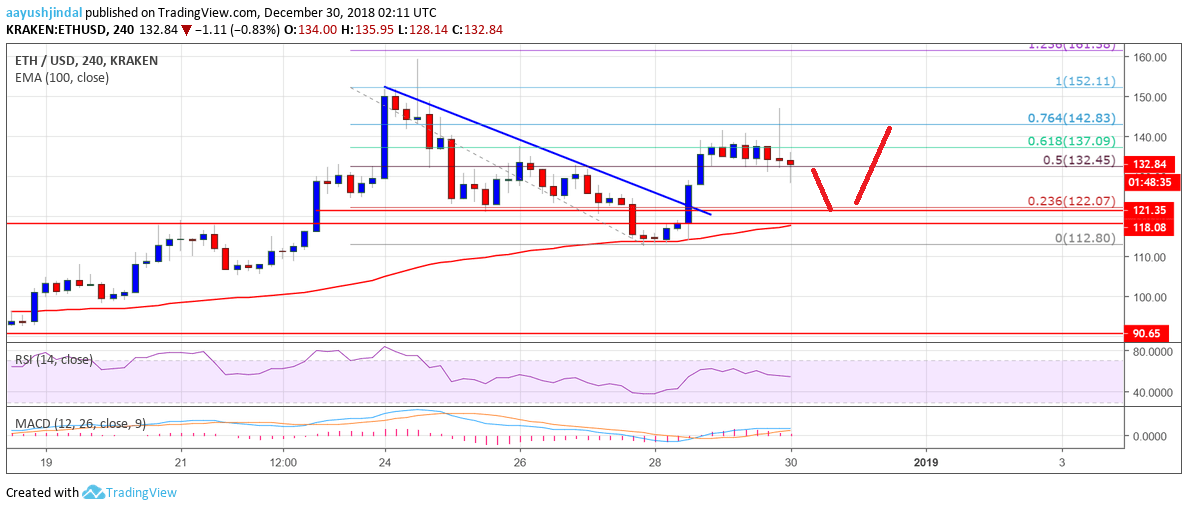

- ETH price started a major upward move after forming a low at $112.80 against the US Dollar.

- There was a break above a major bearish trend line with resistance at $122 on the 4-hours chart of ETH/USD (data feed via Kraken).

- The pair is now placed in a positive zone, but it is struggling to clear the $142 resistance area.

Ethereum price moved back higher versus the US Dollar and Bitcoin. ETH/USD must surpass the $142 resistance to continue higher in the near term.

Ethereum Price Analysis

This past week, ETH price declined below the $130 and $120 support levels against the US Dollar. The ETH/USD pair traded as low as $112.80 and later formed a solid support. It seems like the $112 area and the 100 simple moving average (4-hours) provided support. Later, the price started a strong upside move and traded above the $125 and $134 resistance levels.

There was a break above the 50% Fib retracement level of the recent decline from the $152 swing high to $112 swing low. Moreover, there was a break above a major bearish trend line with resistance at $122 on the 4-hours chart of ETH/USD. The pair also cleared the $138 resistance, but it struggled to clear the $142 resistance. Besides, the 76.4% Fib retracement level of the recent decline from the $152 swing high to $112 swing low also acted as a resistance. The price is currently trading in a range near the $130 level and it may make the next move soon.

The above chart indicates that ETH price could dip a few points towards the $128 or $122 level before the next upside move. A break above the $142 and $144 resistance levels may clear the path for more gains. The next resistance is at $152 followed by $155.

4-hours MACD – The MACD is slightly placed in the bullish zone.

4-hours RSI – The RSI is placed just above the 50 level.

Major Support Level – $128

Major Resistance Level – $142

The post Ethereum Price Weekly Analysis: ETH Facing Strong Resistance Near $140 appeared first on NewsBTC.

by Aayush Jindal on December 30, 2018 at 09:38AM